W 4 Single Example

2020 W-4 SAMPLE - claiming 'single'.pdf This sample document provides instructions on how to complete 2020 W-4 federal tax withholding certificate if an employee has evaluated their tax situation and determined that claiming 'single' is appropriate for their situation. You have three choices for your W-4 filing status as it relates to your marital status. Each may have a different affect on your withholding status, depending on your situation. Your 2019 W-4 filing status choices are: Single: W-4 Single status should be used if you are not married and have no dependents.

Form W-4 is a tax form that employees fill out to adjust how much tax needs to be withheld from their income. Form W4 example for single filers can be found in the rest of this article.

First and foremost, if you don’t file Form W4, your employer will consider you as a single filer with only the standard deduction on the tax return. Having said that you should fill out Form W4 before your employer starts processing payroll.

For single filers, Form W4 is filled out the same way as any other employee with any other filing status.

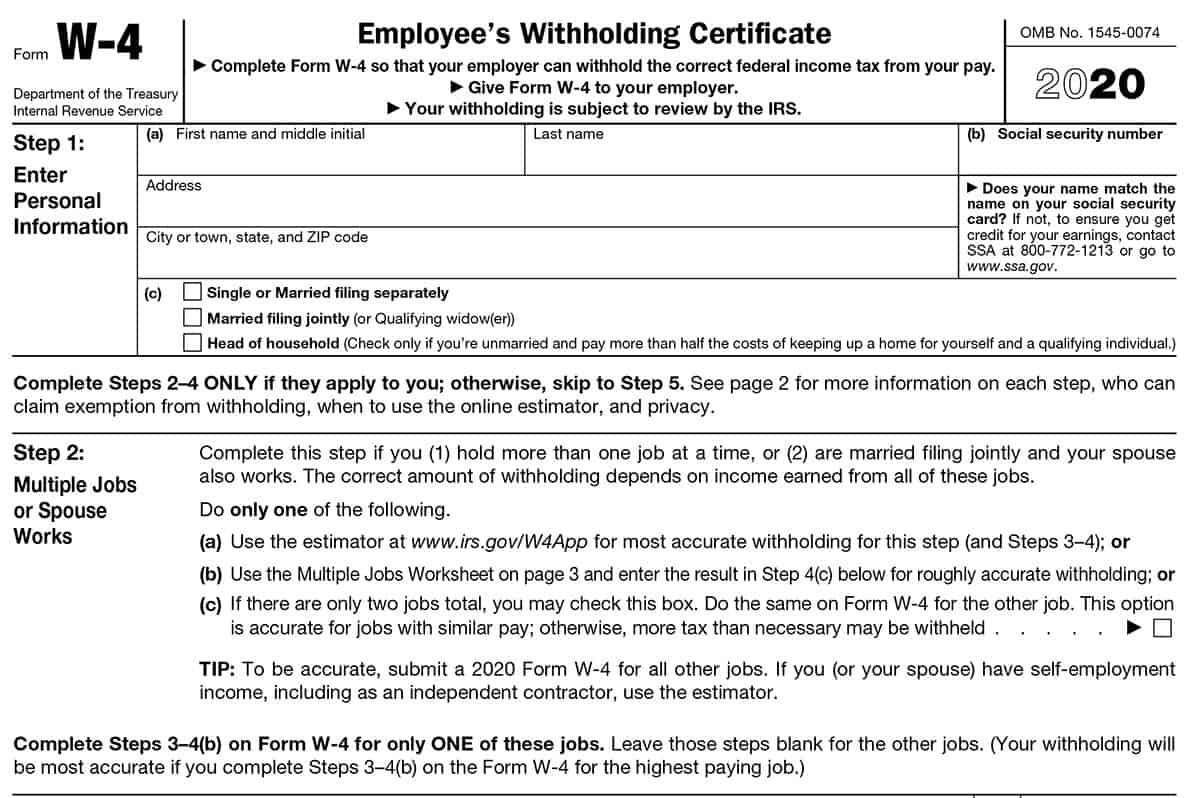

Form W4 Part 1

On Part 1 of 2021 Form W4, select your filing status as “Single or Married filing separately” and enter the rest of the personal information asked.

Form W4 Part 2 and Part 3 for Single Filers

Since you’re single, the parts where it concerns those who are filing a joint return doesn’t really involve you. If you’re holding a secondary job and both jobs pay you a similar amount, check the box on Part 2 (c). Check the box also for the secondary job you have.

In Part 3, you will claim dependents if you have any. Assuming you don’t, you can just skip this part. But, if you have dependents and you pay more than the half the cost of keeping up a home, you may qualify to file taxes as head of household. If you’re qualified, make sure that you do so since you get a lower tax rate and a higher standard deduction in 2021.

Form W4 Part 4 and Part 5 for Single Filers

W4 For Single Person

Part 4 of Form W4 is where you make adjustments to income. If you earn income outside of your job and you want to withhold tax for that from your wages, you have the option to do so. You can enter the income you expect to earn through retirement, interest, dividends, etc. This is for Part 4(a).

On Part 4(b), you will enter the anticipated deduction amount for the 2021 taxes. If you’re itemizing, use the Deductions Worksheet on Page 3 of Form W4 2021 and enter the result on 4(b).

If you want to withhold extra tax in addition to what your employer would withhold regularly, you can enter the extra withholding amount Part 4(c). Since you’re a single individual, you will withhold at a higher rate than married individuals and heads of households. So extra withholding isn’t necessary in most cases.

Lastly, enter your signature, date of completion, and the rest will be filled out by your employer.

If you’re filling out a Form W-4, you probably just started a new job. Or maybe you recently got married or had a baby. The W-4, also called the Employee’s Withholding Certificate, tells your employer how much federal income tax to withhold from your paycheck. The form was redesigned for 2020, which is why it looks different if you’ve filled one out before then. The biggest change is that it no longer talks about “allowances,” which many people found confusing. Instead, if you want an additional amount withheld (perhaps your spouse earns considerably more than you), you simply state the amount per pay period. Here, we answer frequently asked questions about the W-4, including how to fill it out, what’s changed and how the W-4 is different from the W-2.

Go beyond taxes to build a comprehensive financial plan. Find a local financial advisor today.

Why Do I Need to Fill Out Form W-4?

As just noted, the form tells your employer how much federal income tax to withhold from your paycheck. You’ll need to complete a new W-4 every time you start a new job. If your new company forgets to give you one for some reason, be sure to ask. If your employer doesn’t have a W-4 form from you, the IRS requires it to treat you as a single tax filer, which means withholding the highest possible amount from your paycheck for taxes. You can get back the amount you overpay, but only in the new year when you file your tax return.

Do I Need to Submit the New Form W-4?

You should complete the redesigned W-4 only if you started a new job – or if your filing status or financial situation has changed. You do not need to fill out the new form if you have not changed employers. Your company can still use the information provided on the old W-4 form.

How Long Does It Take for W-4 Changes to Be Implemented?

When you submit a W-4, you can expect the information to go into effect fairly quickly. But how long exactly before your paycheck reflects the changes largely depends on your payroll system. Ask your employer when you turn in the form.

How Is the New W-4 Different from the Old W-4?

The biggest change is the removal of the allowances section. You no longer need to calculate how many allowances to claim to increase or decrease your withholding. The new form instead asks you to indicate whether you have more than one job or if your spouse works; how many dependents you have, and if you have other income (not from jobs), deductions or extra withholding. The new form also provides more privacy in the sense that if you do not want your employer to know you have more than one job, you do not turn in the multiple job worksheet.

How to Fill Out the W-4?

As far as IRS forms go, the new W-4 form is pretty straightforward. It has only five steps. If you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out Step 1 (your name, address, Social Security number and filing status) and Step 5 (your signature).

If you have more than one job or your spouse works, you’ll need to fill out Step 2. If you have children, Step 3 applies to you. And if you have other income (not from jobs), you’ll be itemizing your deductions on your tax return or you want an extra amount withheld (including from other jobs), you can indicate your adjustments in Step 4.

How to Fill Out Step 2: Multiple Jobs or Spouse Works?

If your spouse works and you file jointly or if you have a second or third job, you can use either the IRS app or the two-earners/multiple jobs worksheet (page three of the W-4 instructions) to calculate how much extra should be withheld (you put this amount in Step 4). If there are only two jobs (i.e., you and your spouse each have a job, or you have two), you just check the box. (Your spouse should do the same on his or her form or you check the box on the W-4 for the other job, too.)

How to Fill Out Step 3: Claim Dependents?

You fill this out if you earn $200,000 or less (or $400,000 or less for joint filers) and have dependents. It’s a simple calculation where you multiply the number of children under age 17 by $2,000 and the number of other dependents by $500 – and add the two sums.

How to Fill Out Step 4a: Other Income (Not from Jobs)?

If you have interest, dividends or capital gains that you’ll owe taxes on, you can indicate here the total amount of non-pay income here. Your employer will figure it into how much taxes to withhold from your paycheck.

How to Fill Out Step 4b: Deductions?

The deductions worksheet requires some math. You’ll also need to know how much you claimed in deductions on your last tax return. If you claimed the standard deduction, you don’t need to fill this out. If you claimed more than the standard amount, this worksheet will help you calculate how much more. Once you have this amount, you add any student loan interest, deductible IRA contributions and certain other adjustments. You then put this total on the form.

If you get stuck, use the IRS’s withholding app.

How to Fill Out Step 4c: Extra Withholding?

If you will owe more in taxes than what your salary alone would indicate, you can say here how much more you want withheld per pay period. If the extra amount is because your spouse works or because you have more than one job, you enter the amount you calculated in Step 2 – plus any other amount you want withheld.

How Does the W-4 Form Differ From the W-2?

Yes, both of these forms start with the letter ‘w,’ but that’s where the similarities end.

W 4 Single Example Worksheet

Unlike a W-4, a W-2 form is what your employer fills out for all employees and files with the IRS. It shows your annual earnings from wages and tips. It also states the amounts withheld for the year for Social Security, Medicare, state, local and federal income taxes.

The Bottom Line

If you aren’t switching jobs or going through life changes, you don’t need to refile your W-4 just because the form has changed. However, all new employees need to fill out a W-4 to avoid overpaying taxes. While the form is more straightforward and doesn’t include allowances like it did in the past, it’s still important to properly and accurately list information on your W-4.

Tax Planning and Your Financial Plan

- Income taxes are just one aspect of tax planning. If you want to preserve what you’ve earned and grow it in the most tax-efficient way, a financial advisor can help. To find a financial advisor to work with, use SmartAsset’s free tool. It connects you with up to three advisors in your area. If you’re ready to be matched with local advisors, get started now.

- Starting a new job? Even before you fill out your W-4, you can get an estimate for how much your take-home pay will be. Just use our paycheck calculator.

Sample W4 For Single Person

Photo credit: IRS.gov ©iStock.com/PeopleImages, ©iStock.com/wdstock